Interview with Aaron Schneider - July 2020

ERCG continues its ABC leadership interview series with Aaron Schneider, Director of Sales at Metrus Energy. Metrus Energy is a pioneer in the energy efficiency-as-a-service market. We sat down with Aaron and discussed several topics, including –

- Why the “as-a-service” model is gaining traction

- Partnership opportunities up and down the chain

- Delivering more value to sustainability/ESG-focused customers

ERCG: Metrus Energy is a pretty unique company. What is the company’s background?

Aaron Schneider: Our CEO, Bob Hinkle, started the company back in 2008. Bob had a vision to take the first principles of three unique businesses – software as a service, performance contracting, and project finance – and shape them into a new product: Energy Efficiency as a Service.

Today we are in 26 states. We’ve developed over 36

million square feet of properties and saved over 1.5 billion kWh for our customers. Net net we have reduced carbon emissions by 1.1 million tons.

ERCG: Many are familiar with the concept of traditional energy savings performance contracting

(ESPC), where the facility upgrade is paid for using the savings delivered. What are the limitations of ESPC and how is this an improvement on that concept?

AS: We partner with the leading energy services companies that deliver performance contracting. The model has had a ton of success over the years. But I think there are two big concerns when organizations look at these $5M, $10M, $20M projects. #1 – what’s my risk? #2 – is this going on my balance sheet?

We wanted to remove these concerns. And we did this in two ways.

First, we made the decision to underwrite our projects to 100% project performance. So we take on all risk.

And then by going to an as-a-service model, the accounting treatment is off the balance sheet. Our customers only pay for performance. This is very different than taking out a loan or lease or using your own capital where you still have risk that the project does not deliver as expected and you have a shortfall in savings and are going out of pocket to pay off your note.

ERCG: Along the same lines, who is the ideal customer and why is this service necessary? What market gap are you trying to fill?

AS: A large scope of work is important – I’d say $5-$10M is a great place to start. And a customer who wants to improve on their ESG rankings. Those two things are a great combo.

We’ve done a lot of work with industrials, healthcare/hospitals, and colleges.

I am bullish on healthcare and industrials – we keep finding efficiency upgrade opportunities. And then I’d say companies that deliver household products are also super-focused on sustainability, so there’s a good fit there too.

An interesting opportunity is the public sector. With budget issues looming, public agencies need help.

Overall, there is less of an appetite now to do deals that add debt to the balance sheet – even if rates are really really low and the project has a great ROI. And forget about cash. So you have aging infrastructure, and low rates, but an unwillingness to take risk. We solve all of that.

ERCG: Do you have any preferred efficiency measures?

AS: We’ve done over 30 different types of measures. We are agnostic about technology. Our mission is to enable a low carbon economy, so we want to do as many measures as we can. I’d mention that water savings is picking up as a key measure.

ERCG: Great, let’s get into the weeds a bit. Who owns the equipment?

AS: Metrus owns the equipment.

ERCG: How long is the Efficiency Services Agreement (ESA)?

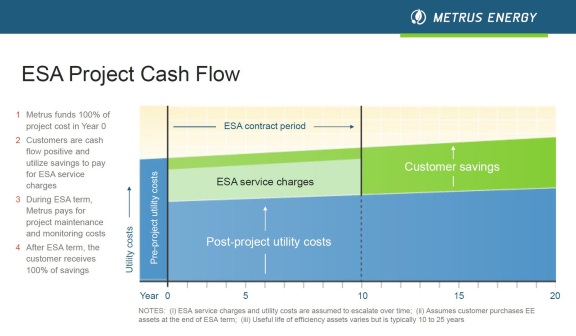

AS: We have an illustrative project cash flow graphic at the bottom of the screen.

The Efficiency Services Agreement is typically 5-10 years. I’d say 7-8 is typical for corporate.

For public sector – we can go out longer. 10-20 years. I’m seeing 10-15 years as the typical range.

ERCG: What does the customer pay?

AS: The customer pays for the “efficiency savings” produced by the assets. The rate the customer pays depends on the customers goals – shorter term vs longer term, more savings vs more asset replacement, etc.

Let’s say we agree to set the efficiency savings rate at 75%. If Metrus produces $100 in efficiency savings, then the customer would pay Metrus $75. If no savings are produced, there is no payment to Metrus.

Keep in mind that Metrus pays for all of the up-front capital costs to do the project – the development fees, the construction, and the new equipment. So the customer is always cash flow positive and they do not carry performance risk.

ERCG: What happens at the end of the ESA?

AS: At the end of the ESA, there is a fair market value assessment of the equipment. The customer has the option to buy-out the equipment, renew an agreement with Metrus (typically with some new scope), or they may elect to have the equipment removed.

ERCG: How is energy efficiency as a service similar to or different from a solar lease?

AS: Well, what we are doing is not a lease. That’s an important distinction. Leases are considered on balance sheet.

What we do is similar to a solar power purchase agreement, except we are delivering negawatts instead of kilowatts.

ERCG: I’m thinking about the various types of energy contracts out there. If we restrict this question to just competitive retail markets, commercial and industrial customers can have a very wide range of contract terms. Contract length is typically 2-3 years but can be over 10 years in some cases. In some states, contracts can vary based on usage and peak load. How do you work with customers to design an ESA that accommodates the range of possible competitive supply contracts?

AS: Great question.

First things first, our customers think of us as a hedge against energy price risk.

Getting at the mechanics of the question, it all comes back to everyone aligning on a set of assumptions about future market conditions and about operating hours.

There is flexibility within the ESA to align based on each individual customer’s operations.

ERCG: What is your message to the competitive retail suppliers out there that don’t do a lot of deals in the efficiency upgrade space? What is the benefit in partnering with a company like Metrus?

AS: Every good account manager wants to bring more value to their customers. It’s how you build loyalty and trust. It’s simply good business. Partnering with Metrus is a great way to bring more to your customers. And it shows you are truly thinking of what’s best for your client, and not just transacting on the next deal.

Of course, we also typically pay a development fee when we close a referral deal.